By Lexington Souers

Nearly 31% of the 37 million Americans with diabetes use insulin to manage the condition. Annually, patients spend an average of $434 on insulin. That amount nearly doubles for patients who are uninsured for an entire year. Between 2014 and 2017, uninsured people represented 80% of the diabetic population that paid full price for an insulin prescription, according to a study by the Commonwealth Fund. Estimates suggest around 27% of a patient’s total out-of-pocket health care spending went toward purchasing insulin. This high out-of-pocket cost can lead to insulin rationing, a dangerous decision that may result in higher medical costs. Rationing insulin can lead to emergency room visits, amputations and death. Uninsured American’s are more likely to ration their insulin. A 2021 survey found that of the 17% of insulin dependent patients that rationed their insulin, 29% were uninsured.

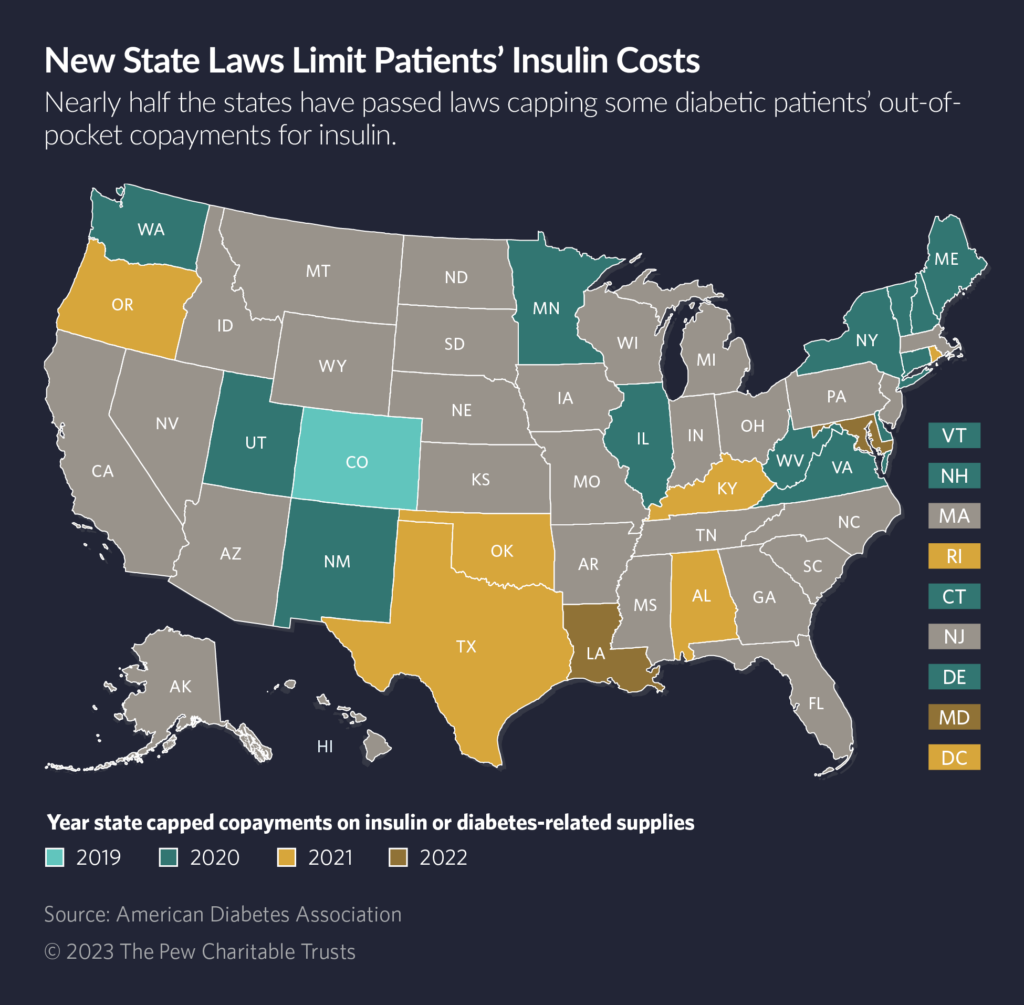

Beginning with Colorado in 2019, 22 states and the District of Columbia enacted price caps for insulin distributed to those who were insured. Legislation for insulin caps received broad bipartisan support from lawmakers, who recognize the dangers of insulin rationing because of cost. These caps range from $25 to $100 a month depending on the state. Many caps do not cover diabetes related equipment, with fewer than five states capping the cost of supplies or devices such as pumps, blood glucose monitors and syringes.

In 2023, 11 states proposed legislation to cap insulin prices and others have brought legislation to ease the costs of diabetes related equipment. Montana, Arizona and California proposed a $35 per 30-day supply cap, while Missouri lawmakers proposed a cap at $30 for a 30-day supply. The measure in Montana was enacted and signed by the governor. In California, the bill passed in both chambers, but California Gov. Gavin Newsom vetoed the legislation. Many states also allow patients to pay a lower copay, so long as the copay is less than the capped price. Nebraska has two bills up for debate during this year’s session. One bill would cap insulin at $35 for 30 days, while the other would cap the price at $100 for a 30-day supply. Both bills received support from community stakeholders. One of the bills, LB 799, was added to another bill which successfully became law. Massachusetts lawmakers filed legislation in 2022 that would cap both insulin and the supplies needed. The proposed legislation would cap a 30-day supply of insulin at $25, oral medication at $50 per 30-days and equipment at $100.

States have recognized diabetes costs often extends past prescription drugs, given that other tools are often needed for the body to effectively utilize insulin. In 2022, Rhode Island capped diabetes equipment and supplies costs at $25 per 30-day supply for insured citizens. Connecticut, Delaware and the District of Columbia have similar caps on supplies. This year, Kansas and Kentucky lawmakers also filed legislation to cap the cost of diabetes equipment. Kentucky’s HB 376 did not receive a committee hearing, and the Kansas bill remained in the Committee on Health and Human Services. Florida lawmakers successfully passed HB 967 which will provide coverage for continuous glucose monitors for Medicaid recipients meeting certain requirements.

While states with insulin caps are aiding insured Americans, there are limits on who legislation can help. Compliance with the Employee Retirement Income Security Act of 1974, known as ERISA, means states are unable to regulate self-insured plans, which comprise 64% of the total employer-based insurance market. State can create programs for the uninsured or underinsured. Colorado and Minnesota place caps on how much an uninsured or underinsured person pays for insulin. Pharmaceutical drug companies capped certain insulin types at $35 per 30-day supply or established assistance programs offering free insulin. Programs created by drug manufacturers often have complex requirements and lack transparency, disqualifying many who need access to insulin.

Insulin prices are due, in part, to the production process. Insulin is a biologic product, which is typically more expensive to make than chemically derived drugs. The three pharmaceutical companies that dominate the insulin market supply all of the insulin in the U.S., along with a majority of the global market. This allows those companies to set the market price, despite low production costs for insulin. Studies have found that an increase in biosimilar products would save payers, patients and other stakeholders an estimated $4.1 billion in savings over a five-year period.