State policymakers offer unique, viable solutions to common issues in 2023

By Lexington Souers

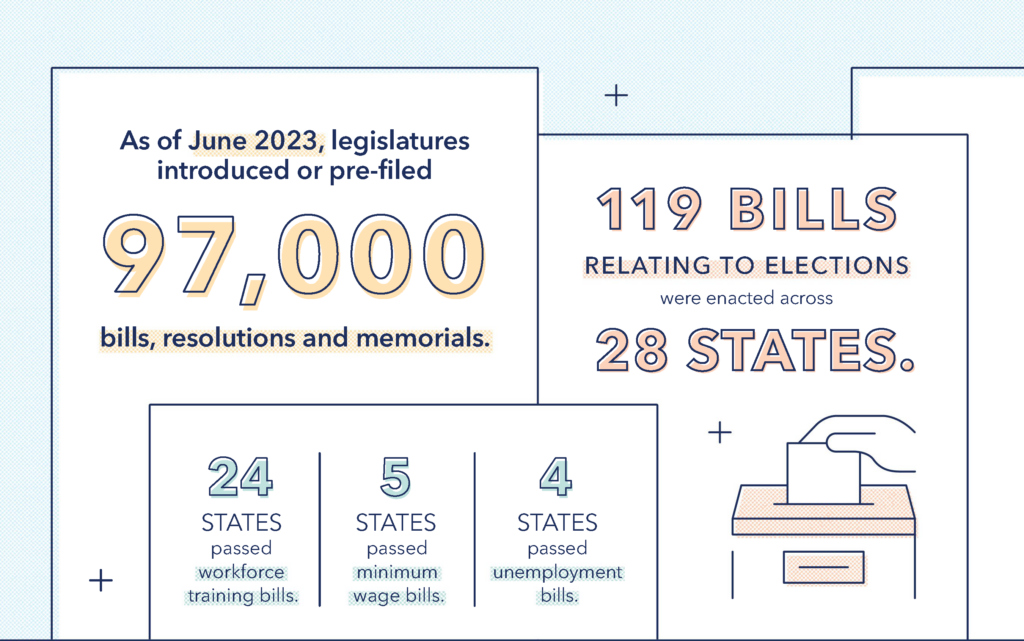

Legislatures in 2023 have introduced or pre-filed more than 97,000 bills, resolutions and memorials. Of those, at least 14,000 were enacted into law by June, ranging from workforce development to pass-through entity taxes.

WORKFORCE DEVELOPMENT

Once COVID-19’s societal impact subsided, states attempted to remedy workforce concerns by passing legislation on sector specific programs, regional development plans and interstate compacts. In 2023, more than 30 bills on interstate compacts have been enacted in more than 15 states.

The Kansas Legislature enacted HB 2288, enabling mental health professionals to join the multistate Counseling Compact. Rep. Susan Ruiz, who helped pass the bill, said its success is a win-win for providers, patients and Kansans. Ruiz is the ranking member of the Health and Human Services Committee and a licensed clinical social worker.

“This is a very bipartisan effort to enhance our workforce,” Ruiz said. “We have put a lot of funding into enhancing our mental health services across the board, but we need the practitioners involved to bring all that to fruition. So, anything that we could do to enhance our workforce, we did it.”

Ruiz said HB 2288 allows practitioners licensed in another state to practice in states that are members of the compact. Practitioners must maintain their licensure, undergo a background check and complete other requirements. Due to these safety measures, patients can feel confident in a provider and protect their continuity of care, which Ruiz said could be “devastating” if interrupted.

Almost every bill on workforce training was passed, leading 24 states to pass more than 85 bills. Minimum wage bills were enacted in five states and 15 unemployment bills passed in four separate states.

ELECTIONS

By June, legislators filed more than 1,700 bills relating to elections. Of those, 119 were enacted across 28 states. While the focus of legislation varied, many bills enhanced protections for election officials. It’s those workers who help “operationalize democracy,” according to former election official Veronica Degraffenreid, senior manager of strategic partnerships, elections and government at the Brennan Center for Justice.

Degraffenreid said the Brennan Center completed three surveys, the most recent of which notes that one in three election officials have been abused, harassed or threatened, with three in four seeing an increase in threats.

“What I believe policymakers and lawmakers are doing is a pragmatic approach. They’re like ‘let’s do something and address it,’ but understand that along with the pragmatism is a passion that these are people in our communities. They are our friends. They are our neighbors. We go to school with them and to religious services with them or ballgames. It’s their job to carry out the work and carry out their responsibilities. It’s absolutely something that we need to do, but we should want to do it, and want to make sure that we protect the lives and the livelihood of these American citizens.”

— Veronica Degraffenreid, senior manager of strategic partnerships, elections and government at the Brennan Center for Justice.

Legislation protecting election officials generally follows three paths that potentially result in increased funding, mounting criminal penalties for perpetrators, and/or additional information protection. Funding adds to the physical safety of election offices and polling places. Legislation surrounding doxing prevention and implementing address protection programs allows for increased physical safety and prevents malicious action against an election administrator or poll worker.

“If we want voters, however they participate, to have faith and confidence in the process and the people who are performing those duties, we want election administrators to be focused on conducting fair, accurate and safe elections; we want them to do their duty, their job that is dictated by federal and state law.”

TELEHEALTH

Originally designed to provide health care access to rural and underserved areas, telehealth is now in widespread use. However, the popularity of telehealth, especially following its use in 2020, highlighted a need for increased regulation. Legislation in 2023 expanded existing framework to allow out-of-state providers to work with a certain state’s patients, increases prescribing ability for certain drugs and payment parity for services. Multistate legislation could be helpful in allowing providers to uphold state specific licensure requirements, meaning patients have a wider range of care.

Across 22 states, 44 telehealth bills were enacted this year entering June. These bills expanded funding and access to telehealth. Virginia SB 1418, which passed on March 21, permits telehealth entities with state licensed health care providers do not need to maintain an instate address to enroll as a vendor or provider group under Medicaid. The bill also allows health care providers to not maintain a physical presence in the Commonwealth to enroll as a Medicare provider.

“This is a bill with a significant impact on access to quality health care for Virginians, especially those in rural areas like southwest Virginia, which I represent,” said Virginia Sen. Todd Pillion. “In short, it fixes a systemic problem in Medicaid enrollment for Virginia-licensed providers. Prior to this bill, a Virginia licensed provider or provider group must have a physical address in Virginia in order to enroll in the Medicaid program.”

This allows licensed providers who do not have a physical Virginia address to aid patients. At the same time, patients can know the care they are receiving meets state licensing standards and other Medicaid qualifications. Pillion said the legislation reduces regulatory burdens and allows Medicaid to “leverage telemedicine” to better serve both providers and patients.

“The more we can do to reduce regulatory burdens and enhance quality of life, while increasing health care options, is a win for patients, providers and rural communities.”

— Sen. Todd Pillion, Virginia

INSULIN

More than 29 bills filed in 23 states were aimed at capping the cost of insulin and other diabetes care-related supplies. Despite recent federal caps, many Americans with diabetes still face high annual insulin costs. In response, states and private companies are capping costs in specific circumstances.

Insulin is relatively easy to produce, given its chemical makeup, but patients are often paying at least four times the amount those in other countries do. Additionally, the cost of pumps and other supplies are often not covered under a cap.

In North Dakota, Sen. Tim Mathern introduced SB 2140 to cap monthly copays at $25 for insulin drugs and supplies for health insurance programs. Mathern said the bill went through several iterations in both house and senate committees.

“The challenge is never-ending — to create a world where each and every person has the right to affordable, accessible and quality health care,” Mathern said. “SB 2140 is one small step toward that goal which I have been working on in the senate since 1986.”

Mathern suggested connecting with families experiencing diabetes and federal advocates to explain the importance of capping insulin costs. As well, he suggested increased education on the issue, especially because of an existing federal cap.

“A challenge in the drafting was identifying what specific items were to be covered by the $25 cap,” Mathern said. “I also found, as a democrat in a red state, it was a great boost to have republican cosponsors.”

CAREER AND TECHNICAL EDUCATION

Career and technical education, or CTE, is defined in the Strengthening Career and Technical Education for the 21st Century Act of 2018 as a series of courses that prepares students for futures in technical skills or industries, works to solve the skills gap. Studies show that involvement in CTE leads to higher wages, especially after the completion of advanced coursework. Spreading awareness of these programs and knowledge of the typical CTE student helps increase program success. In addition, integrating CTE courses into high school curriculum provides a benefit for students who may have chosen other classes to meet strict graduation requirements.

High school career and technical education courses prepare students for entry into the workforce by offering hard and soft skills specific to an industry. Students can use these skills immediately after graduation or in postsecondary training. States report that high school students taking at least two CTE courses have a 95% graduation rate. CTE programs provide skilled employees in professions facing labor shortages.

In 2023, 23 bills concerning career and technical education were enacted. At least eight states passed legislation allowing CTE courses to count as high school credit or meet a graduation requirement. Six states — Colorado, Georgia, Hawaii, Idaho, Kansas and Washington — passed general legislation concerning career and technical education, including pilot programs for nurses and joint studies on high school program enrollment.

PASS-THROUGH ENTITY

This year, seven states joined 28 others with pass-through entity taxes, according to the American Institute of Certified Public Accountants. An additional two states have also proposed legislation. A partnership, such as an LLC, can elect to pay state and local taxes at the entity level, rather than having those costs “pass through” to the owners. This offers the owner a federal income tax credit to reduce their personal federal income tax. Due to disparities in state taxes, some state residents paid more than others in federal income taxes despite similar incomes. By passing legislation allowing pass through taxes, states can balance the cost of taxes on some citizens.

“We think this will help our West Virginia small businesses that are organized as pass-through entities decrease the amount that owners would have to pay in federal income tax,” said West Virginia Sen. Mike Oliverio, who sponsored SB 151. “In turn, we’re hopeful that will enable them to invest more money into their business, pay more money to their staff, or simply enjoy more the dollars that they’ve earned from their business.”

Oliverio said states have taken various approaches to legislating pass-through taxes, and given that the federal government was not preventing states from passing legislation, he and other West Virginia legislators wanted businesses to have the same benefits as other states.

“At some point, there has to be a balancing of what each of you respectively pay to the federal government in taxes as well,” Oliverio said. “The citizen in West Virginia versus the citizen in [a high tax state] is enjoying the same benefits of the CDC, the United States Army, the Postal Service and all those federal agencies that they’re funding with their taxes.”